Rate of sales tax 2. Sales Tax 5 for fruit juices basic foodstuffs building materials personal computers telephone and watches.

Energies Free Full Text Electric Vehicles In Malaysia And Indonesia Opportunities And Challenges Html

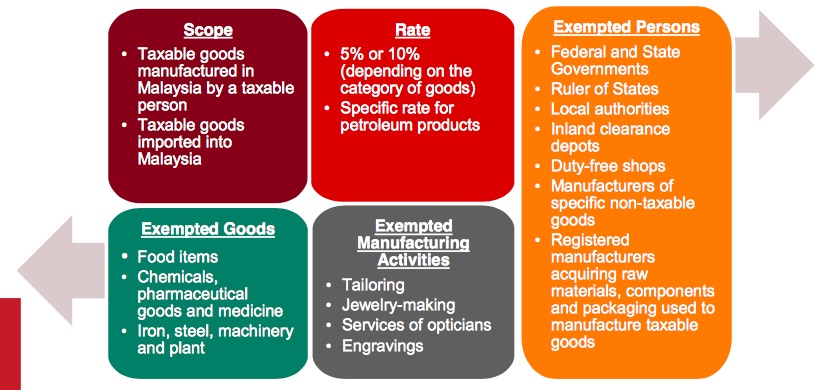

1 The rate of sales tax to be charged and levied shall be fixed at ten per cent on all goods except a goods which are included in any exemption order made under section 35 of the Sales Tax Act 2018.

. Services SST on services is only due when supplied to the non-tax registered final consumer. This includes a liability on imported goods a low-value exemption may apply. It replaced the Goods and Services Tax GST which was levied as the sole revenue collection mechanism in Malaysia.

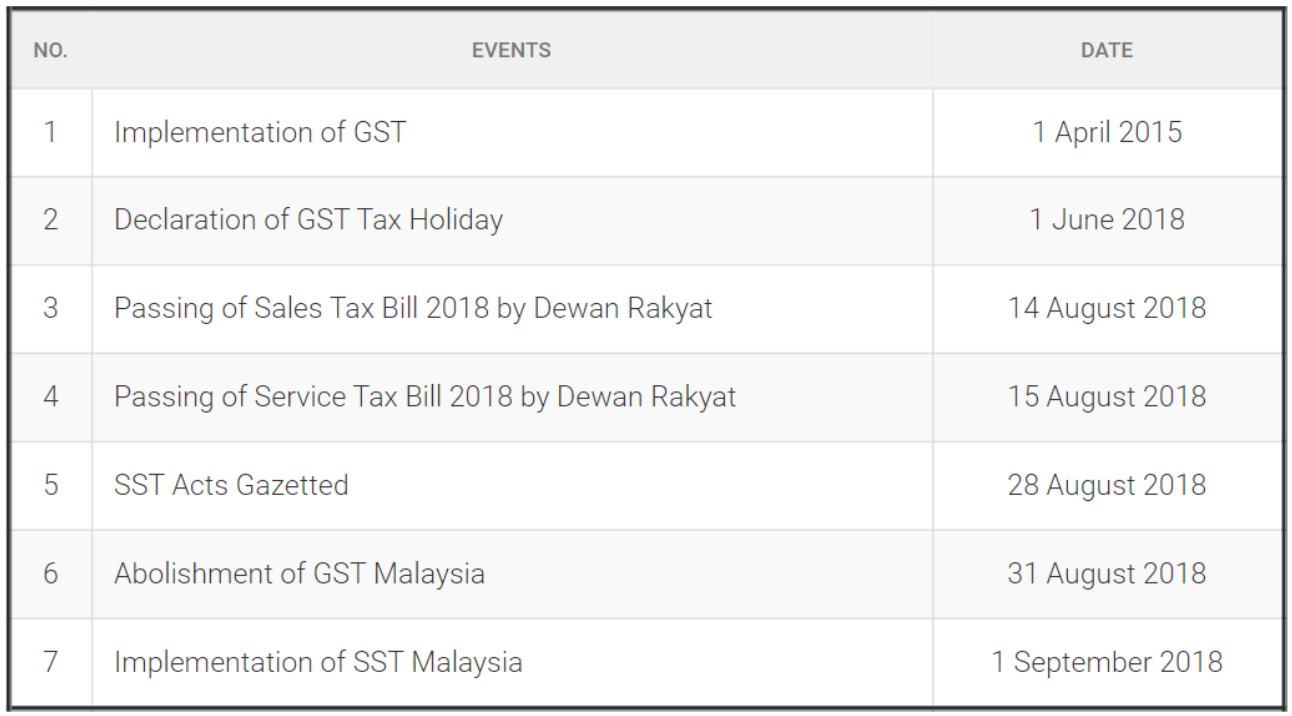

September is here and Malaysia has entered into the new period of the Sales and Services Tax SST. Now that the implementation of SST has begun Malaysians are curious to see how prices have changed since 1 September. Sales and service tax is implemented in Malaysia from September 1 2018 What is the standard rate of VAT in Malaysia.

Under the new SST goods are taxed between 5 to 10 percent and services at 6 percent. Whose sales value for taxable items exceeds RM500000 for a year straight is liable to be registered under the Sales Tax Act 2018 in Malaysia. Retailers manufacturer etc.

Fill in tax and price - and get price before tax as result. SST is an ad-valorem tax that is calculated through percentage in proportion to the estimated value of the sales or services. How much is the SST in Malaysia.

Goods are subject to a 5 to 10 sales tax while services are subject to a 6 percent service tax under the new SST. 10 for all other goods except petroleum subject to specific rates and goods not specifically exempted. Malaysia reintroduced the Sales and Services Tax SST to replace the Goods and Services Tax GST beginning 1 September 2018.

The tax rate is usually 5 to 10. Which goods or services. The Sales Tax is levied at the import or manufacturing levels and companies with a sales value of taxable goods exceeding RM500000 in a 12-month period are liable to be registered for the tax which is levied at rates varying from 5 to 10 depending on the goods in question.

You can also choose the tax by clicking the percentage in the table below. In Malaysia it is a mandatory requirement that all manufacturers of taxable goods are licensed under the Sales Tax Act 2018. A taxable person is a person who manufactures taxable goods and is liable to be registered if the annual turnover has exceeded RM50000000 threshold.

Malaysia is to reintroduce its Sales and Services Taxes SST from 1 September 2018 with a likely standard rate of 10. 10 6 5 Tax calculator needs two values. SCOPE AND CHARGE Sales.

Such a person is required to be registered under MySST system. Sales and Service Tax commonly known as SST is the new tax in Malaysia that was implemented on 1 September 2018. Under the new sales tax and service tax framework announced on 16 July 2018 sales tax is levied on the production of taxable goods in Malaysia and the importation of taxable goods into Malaysia at a rate of 5 or 10 or a fixed percentage depending on the category of goods.

The Sales Tax is being reimposed to reassure financial markets that the country can cope with the lose of the GST revenues The planned high-speed railway link to Singapore has already been cancelled because of fiscal concerns. On September 1st 2018 the Sales and Services Tax SST was reintroduced to replace the unpopular Goods and Services Tax GST. United States Sales Tax Calculate United States Sales Tax.

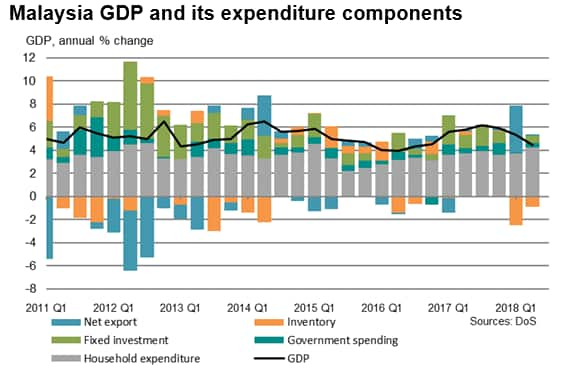

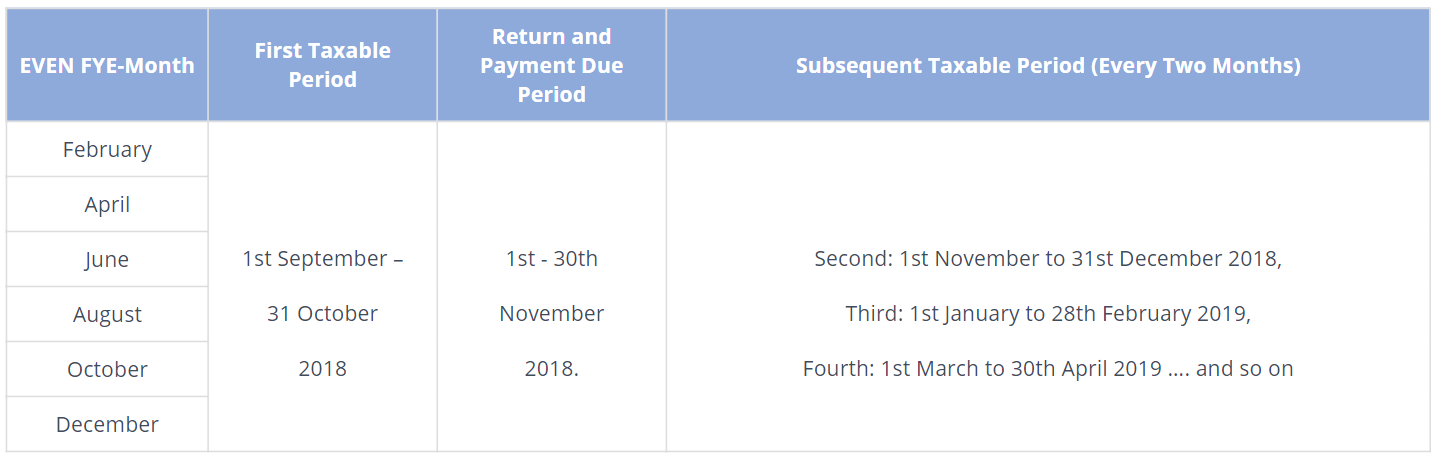

The previous GST regime introduced on April 1st 2015 covered a broader range of items and services at a 6 percent rate. Every company in Malaysia need to declare SST return every 2 month according to the taxable period What is sales tax rate in Malaysia. Pursuant to this please be advised that the new rate on transactions related to MYXpats charges will.

Rates Of Tax 2018 Goods Exempted From Sales Tax Order 2018 Person Exempted From Sales Tax Order 2018 Exemption From Registration Order 2018 Imposition of Tax In Respect Of Designated Areas Order 2018 Imposition Of Tax In Respect Of Special Areas Order 2018 Appointment of Date of Coming Into Operation Order 2018 V 3. FURTHER ASSISTANCE AND INFORMATION ON SST. General Guide On Sales Tax - Ver 4 As at 19 January 2019 All Rights.

Exempted from SST registration are tailoring jewellers and opticians. Th standard rate of VAT in Malaysia is 6. This comes after the tax holiday when the previous Goods and Services Tax GST was zero-rated for the last three months.

Enlisted goods under Sales tax Act are predetermined for its rate of tax which is added with the core price. In accordance to the announcement made by the Malaysian Government on the implementation of Sales and Service Tax Act 2018 effective 1 Sept 2018 the Sales and Service Tax SST will be implemented at MYXpats Centre beginning 1 November 2018. Jabatan Kastam Diraja Malaysia Kompleks Kementerian Kewangan No 3 Persiaran Perdana Presint 2 62596 Putrajaya 1300 888 500 Pusat Panggilan Kastam 1800 888 855 Aduan Penyeludupan 03-8882 21002300 Ibu Pejabat.

It was announced on September 1st 2018 that the Sales and Services Tax SST will be reinstated to replace the controversial Goods and Services Tax GST system GST. Rates of Tax Order 2018 to be imposed on taxable goods which are not exempted by the Minister of Finance through the Sales Tax Goods Exempted From Tax Order 2018 which comes into force on 1 September 2018. Although SST is different from GST in various aspects there are still numerous similarities between these two.

When Should a company need to declare SST return. Sales and service tax Malaysia. In the case of taxable.

Price before tax and price are rounded two digits. 2 This Order comes into operation on 1 September 2018. Goods SST on goods is charged throughout the B2B chain to the final consumer and is not deductible by tax payers.

Gross Domestic Product Gdp In Us Of Malaysia Thailand Indonesia Download Scientific Diagram

1 Nov 2018 Budgeting Inheritance Tax Finance

Malaysia Proposed Sales And Service Tax Sst Implementation Framework Conventus Law

Download Free Image Of Illustration Of Business People Avatar About Training Presentation Group Analysis Artwork And Avatar 409393

Malaysia Manufacturing Pmi Hints At Q3 Upturn After Slower Q2 Ihs Markit

Registering An Enterprise In Malaysia Enterprise Success Business Consulting Business

Malaysia Sst Sales And Service Tax A Complete Guide

Sage Business Cases The 14th General Election And The Changing Business Environment In A New Malaysia

Abolition Of Gst And Transition To Sst In Malaysia Activpayroll

Consumption Tax Distortion To Malaysia S Inflation Is Over Article Ing Think

Sst Rates In Malaysia Vatupdate

1 Nov 2018 Budgeting Inheritance Tax Finance

Energy Use Kg Of Oil Equivalent Per Capita By Malaysia Thailand Download Scientific Diagram

Sales And Service Tax Sst In Malaysia Transitional From Gst To Sst 2 0

Market Breakdown Of Vitamin And Mineral Supplements In Malaysia Rm Download Scientific Diagram

Sales And Services Tax Sst In Malaysia Henry Goh Malaysia Brunei Patent Trade Mark And Industrial Design Agents

Malaysia Sst Sales And Service Tax A Complete Guide

Malaysia Extends Sst Deadlines For Covid 19